Debt Consolidation vs. Debt Settlement: A Comprehensive Guide to Choosing Your Path to Financial Recovery

When overwhelming debt threatens your financial stability, understanding your options becomes crucial. This detailed analysis explores two primary debt resolution strategies—consolidation and settlement—helping you make an informed decision that aligns with your unique circumstances and long-term recovery objectives.

The journey to restore funds base and achieve financial stability often begins with a critical decision: how to address existing debt. For millions of individuals struggling with multiple creditors, high interest rates, and mounting monthly payments, debt consolidation and debt settlement represent two distinct pathways forward. Each approach offers unique advantages and potential drawbacks that can significantly impact your credit profile, overall costs, and timeline to financial freedom.

Understanding the fundamental differences between these strategies is essential for making a choice that not only addresses your immediate financial challenges but also supports your long-term wealth-building goals. This comprehensive guide examines both approaches in detail, providing you with the knowledge needed to evaluate which method best serves your specific situation.

Understanding Debt Consolidation: Streamlining Your Financial Obligations

Debt consolidation involves combining multiple debts into a single loan or payment plan, typically with a lower interest rate than your existing obligations. This strategy doesn't reduce the total amount you owe but restructures your debt to make it more manageable and potentially less expensive over time. The primary goal is to simplify your financial life while reducing the overall cost of borrowing.

"Debt consolidation works best for individuals who have steady income, reasonable credit scores, and the discipline to avoid accumulating new debt while paying off the consolidated loan."

Common consolidation methods include personal loans from banks or credit unions, balance transfer credit cards with promotional interest rates, home equity loans or lines of credit, and debt management plans through credit counseling agencies. Each method has specific requirements, benefits, and considerations that affect its suitability for different financial situations.

The consolidation process typically begins with assessing your total debt, current interest rates, and monthly payments. You then research and compare consolidation options, considering factors such as interest rates, fees, repayment terms, and eligibility requirements. Once approved for a consolidation loan or program, you use the funds to pay off existing debts, leaving you with a single monthly payment to manage. This simplified structure can reduce stress, minimize the risk of missed payments, and provide a clear timeline for becoming debt-free.

The Mechanics of Debt Settlement: Negotiating for Reduced Balances

Debt settlement takes a fundamentally different approach by negotiating with creditors to accept less than the full amount owed. This strategy typically involves stopping payments to creditors while accumulating funds in a dedicated account, then using those funds to make lump-sum settlement offers. The goal is to resolve debts for significantly less than the original balance, often 40-60% of what you owe.

Settlement is generally considered a last-resort option for individuals facing severe financial hardship who cannot realistically repay their full debt obligations. It's most appropriate when you're already behind on payments, facing potential lawsuits, or considering bankruptcy as an alternative. Creditors are more likely to negotiate when they believe settlement represents their best chance of recovering some portion of the debt.

The settlement process can be handled independently or through a debt settlement company. When working with a company, you typically make monthly deposits into a special account while the company negotiates with your creditors. This process can take two to four years to complete and involves significant risks, including damaged credit, potential lawsuits, and tax implications on forgiven debt. However, for those facing insurmountable debt, settlement can provide a path to financial stability that avoids bankruptcy.

Understanding the settlement timeline is crucial for setting realistic expectations. Initial negotiations may begin after three to six months of non-payment, as creditors become more willing to negotiate. Settlements are typically reached one account at a time, meaning you'll continue facing collection calls and potential legal action until each debt is resolved. This extended period of financial uncertainty requires strong commitment and emotional resilience.

Qualification Criteria and Eligibility: Determining Your Options

Your eligibility for debt consolidation or settlement depends on several factors, including your credit score, income stability, debt-to-income ratio, and the types of debt you carry. Understanding these requirements helps you identify which strategy is realistically available and most likely to succeed in your situation.

Debt Consolidation Requirements

- Credit Score:Typically requires a score of 650 or higher for favorable interest rates, though some options exist for lower scores

- Stable Income:Demonstrated ability to make consistent monthly payments on the new consolidated loan

- Debt-to-Income Ratio:Generally should be below 50%, though requirements vary by lender

- Account Status:Accounts should be current or only slightly delinquent for best approval odds

- Collateral:May be required for secured consolidation options like home equity loans

Debt Settlement Considerations

- Financial Hardship:Must demonstrate genuine inability to repay full debt amounts

- Unsecured Debt:Works primarily with credit cards, medical bills, and personal loans—not mortgages or auto loans

- Minimum Debt Amount:Most settlement companies require at least $7,500-$10,000 in total debt

- Available Funds:Ability to accumulate settlement funds through monthly deposits

- Willingness to Accept Credit Damage:Understanding that credit scores will significantly decline during the process

The type of debt you carry also affects your options. Consolidation works well for various debt types, including credit cards, personal loans, medical bills, and even some student loans. Settlement is typically limited to unsecured debts and is most effective with credit card balances. Secured debts like mortgages and auto loans generally cannot be settled without surrendering the collateral, making consolidation or other strategies more appropriate for these obligations.

Impact on Credit Profiles: Understanding Long-Term Consequences

The effect on your credit score represents one of the most significant differences between consolidation and settlement. This impact influences your ability to secure future credit, affects interest rates on loans, and can even influence employment opportunities and housing applications. Understanding these consequences is essential for making an informed decision aligned with your long-term financial goals.

Debt consolidation typically has a minimal negative impact on your credit score, and may even improve it over time. The initial credit inquiry and new account opening might cause a small temporary dip of 5-10 points. However, as you make consistent payments and reduce your overall credit utilization ratio, your score often improves. Closing old accounts after consolidation can affect your credit history length, but maintaining the consolidated loan in good standing demonstrates responsible credit management to future lenders.

In contrast, debt settlement severely damages your credit score, often causing drops of 100 points or more. The process requires stopping payments to creditors, resulting in multiple late payment notations on your credit report. Each settled account is marked as "settled for less than the full balance," which remains on your credit report for seven years from the date of first delinquency. This notation signals to future lenders that you failed to meet your original obligations, making it difficult to obtain new credit and resulting in higher interest rates when credit is available.

"While debt settlement damages credit significantly in the short term, it can be rebuilt over time. Most individuals see substantial credit score recovery within 2-3 years after completing their settlement program, especially when combined with responsible credit management practices."

The timeline for credit recovery differs dramatically between the two approaches. With consolidation, you may see credit score improvements within 6-12 months as you establish a positive payment history. Settlement requires a longer recovery period, typically 2-4 years before your score returns to pre-settlement levels, assuming you implement strong credit-building strategies after completing the program. This extended recovery period should factor heavily into your decision, particularly if you anticipate needing credit for major purchases like a home or vehicle in the near future.

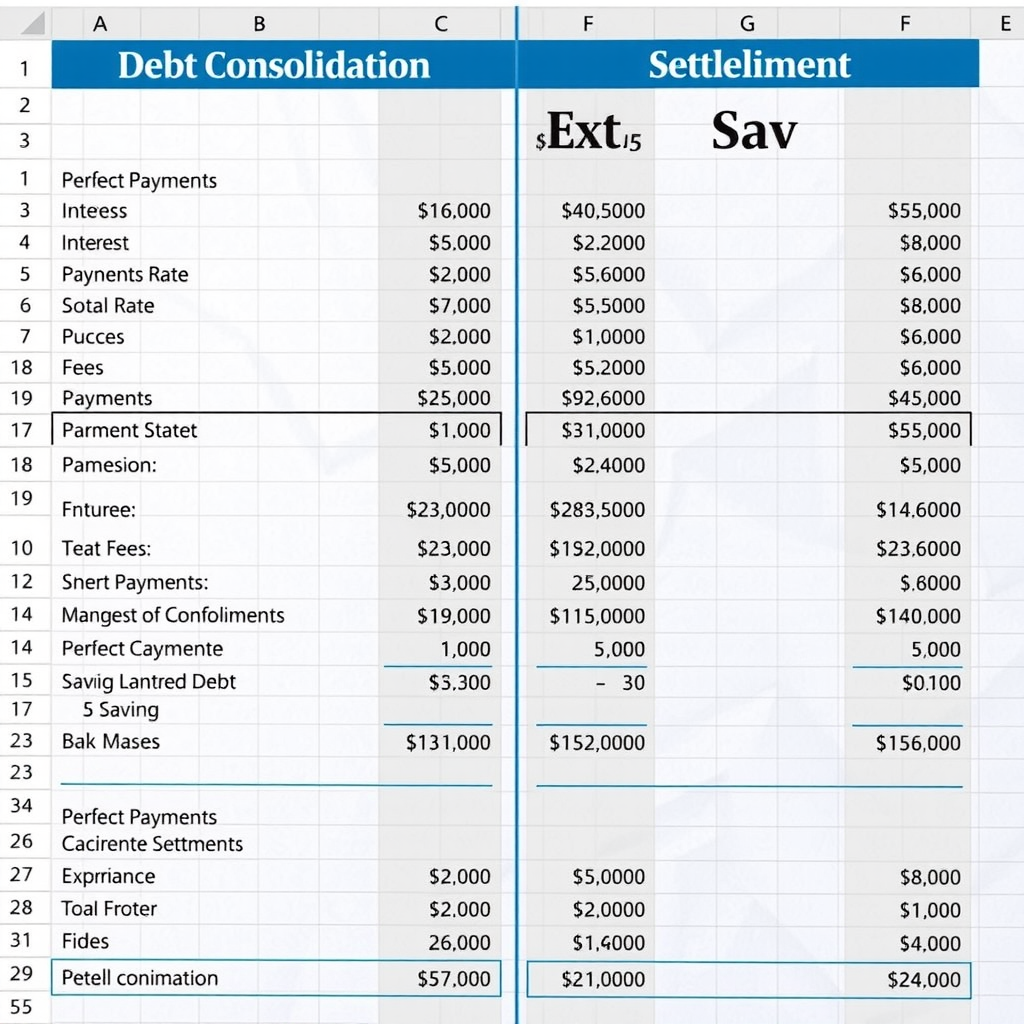

Cost Considerations and Financial Analysis: Calculating True Expenses

Understanding the total cost of each debt resolution strategy requires looking beyond monthly payments to consider interest charges, fees, tax implications, and opportunity costs. A comprehensive financial analysis helps you determine which approach offers the best value for your specific situation and supports your goal to restore funds base effectively.

Debt consolidation costs include the interest charged on your new loan, origination fees (typically 1-8% of the loan amount), balance transfer fees for credit card consolidation (usually 3-5% of the transferred amount), and potential annual fees for balance transfer cards. While you pay the full amount of your original debt, the lower interest rate often results in significant savings compared to maintaining high-interest credit card balances. For example, consolidating $20,000 in credit card debt at 18% APR into a personal loan at 10% APR could save thousands in interest charges over a five-year repayment period.

Debt settlement costs include fees charged by settlement companies (typically 15-25% of the enrolled debt or 15-25% of the amount saved), potential legal fees if creditors sue during the process, and tax liability on forgiven debt amounts exceeding $600. While you pay less than the full debt amount, these additional costs can significantly reduce your savings. Additionally, the IRS considers forgiven debt as taxable income, potentially creating an unexpected tax bill. For instance, if you settle $30,000 in debt for $15,000, you may owe taxes on the $15,000 in forgiven debt, depending on your financial situation and applicable tax laws.

Hidden costs also deserve consideration. With consolidation, the primary risk is extending your repayment period, which may result in paying more total interest despite a lower rate. Settlement involves opportunity costs from damaged credit, including higher interest rates on future loans, increased insurance premiums, and potential employment challenges in fields that review credit reports. These indirect costs can exceed the immediate savings from reduced debt balances, particularly for younger individuals with decades of credit usage ahead.

Sample Cost Comparison: $25,000 in Credit Card Debt

Consolidation Loan (10% APR, 5 years)

- Monthly Payment: $531

- Total Interest: $6,860

- Origination Fee: $1,250

- Total Cost: $33,110

Debt Settlement (3 years)

- Settlement Amount: $12,500 (50%)

- Company Fees: $3,125 (25%)

- Tax on Forgiven Debt: ~$3,000

- Total Cost: $18,625

Note: Settlement costs don't include potential legal fees, credit damage costs, or collection harassment during the process.

Evaluating Your Circumstances: Making the Right Choice for Your Situation

Choosing between debt consolidation and settlement requires honest assessment of your financial situation, future goals, and personal circumstances. Neither approach is universally superior—the right choice depends on your specific context and priorities. Consider these key factors when making your decision.

Choose debt consolidation if:You have steady income sufficient to cover consolidated payments, your credit score qualifies you for favorable interest rates, you want to preserve your credit rating, you can commit to avoiding new debt during repayment, and you prefer the certainty of a structured repayment plan. Consolidation works best when your debt is manageable but scattered across multiple accounts with varying interest rates and payment dates. It's ideal for individuals who need simplification and modest interest savings rather than dramatic debt reduction.

Consider debt settlement if:You're facing genuine financial hardship with no realistic path to full repayment, you're already behind on payments or considering bankruptcy, you have primarily unsecured debt like credit cards and medical bills, you can tolerate significant credit damage for several years, and you have the emotional resilience to handle collection calls and potential lawsuits during the process. Settlement is a last-resort option that makes sense primarily when the alternative is bankruptcy or perpetual minimum payments that never reduce principal balances.

"The best debt resolution strategy isn't always the one that saves the most money in the short term. Consider your entire financial picture, including future credit needs, career plans, and personal stress tolerance when making this important decision."

Your timeline for major life events should also influence your decision. If you plan to buy a home, start a business, or make other major purchases requiring credit within the next 3-5 years, consolidation's credit-friendly approach may be preferable despite potentially higher total costs. Conversely, if you're several years away from needing credit and facing overwhelming debt, settlement's aggressive approach might provide the fresh start you need to rebuild your financial foundation.

Don't overlook the psychological aspects of your choice. Consolidation provides the satisfaction of paying debts in full and maintaining your creditworthiness, which can be important for self-esteem and financial confidence. Settlement requires accepting that you couldn't meet your original obligations, which some find emotionally difficult despite the financial relief. Consider which approach aligns better with your values and psychological needs as you work toward financial stability.

Moving Forward: Your Path to Financial Recovery

Whether you choose debt consolidation or settlement, success requires commitment, discipline, and a comprehensive plan for preventing future debt accumulation. Both strategies offer viable paths to restore funds base and achieve financial stability, but neither works without your active participation and dedication to changing the financial behaviors that led to debt in the first place.

Before making your final decision, consult with a certified financial counselor or advisor who can review your complete financial picture and provide personalized guidance. Many nonprofit credit counseling agencies offer free consultations and can help you understand all available options, including alternatives you may not have considered. Take time to research providers thoroughly, read reviews, understand all fees and terms, and ensure you're working with reputable organizations that prioritize your financial well-being.

Remember that resolving your debt is just the first step toward long-term financial health. Develop a budget that prevents future debt accumulation, build an emergency fund to handle unexpected expenses without credit cards, and establish healthy financial habits that support your recovery objectives. With the right strategy and sustained effort, you can overcome your current debt challenges and build a stronger, more secure financial future.

Your journey to financial stability begins with informed decision-making. Take time to carefully evaluate your options, seek professional guidance when needed, and commit to the path that best serves your long-term financial recovery and prosperity goals.